nassau county income tax rate

One type of the Cost approach adds major. Live Board MeetingsMeeting Minutes.

Media Entertainment Nassau County Ida

NYCs income tax surcharge is based on where you live not where you work.

. Special Permits - Dept. Rates kick in at different income levels depending on your filing status. You can pay in person at any of our locations.

Of Public Works Dumpsters on County Roads Aerial Photos Hauling GPS Monumentation Book Plans Specs. 74 rows The New York sales tax of 4 applies countywide. Income and Salaries for Nassau County - The average income of a Nassau County resident is 42949 a year.

A county -wide sales tax rate of 425 is applicable to localities in Nassau County in addition to the 4 New York sales tax. The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value. Visit Nassau County Property Appraisers or Nassau County Taxes for more information.

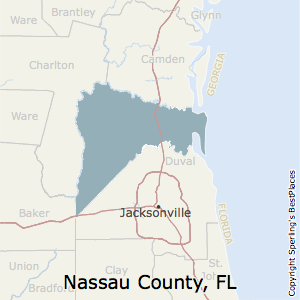

A county-wide sales tax rate of 1 is applicable to localities in Nassau County in addition to the 6 Florida sales tax. National Flood Insurance. Your 2021 Tax Bracket to See Whats Been Adjusted.

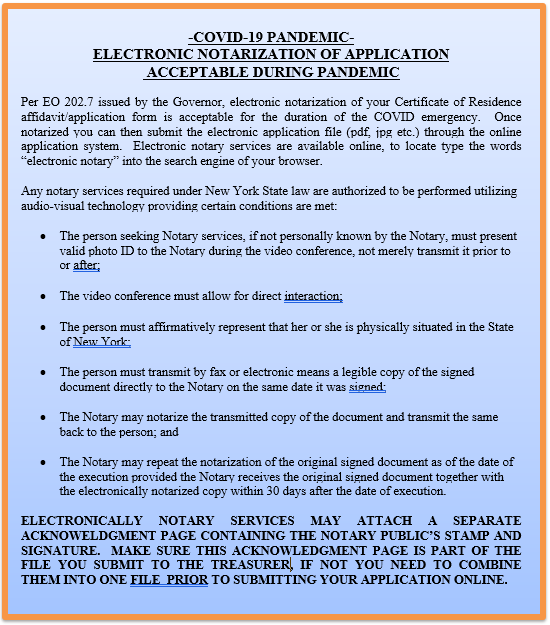

Some cities and local governments in Nassau County collect additional local sales taxes which can be as high as 05. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund transportation districts local attractions etc. Household Size Very Low 50 Low 80 Moderate 120.

65 and older whose annual household income does not exceed 86300 in the year 2017 a partial exemption from School taxes. Doing business with Nassau County QuickLinksaspx. Land Records County Clerks Office.

Average Property Tax Rate in Nassau County. The Nassau County sales tax rate is. Fernandina Beach FL 32034.

Nassau County Housing Strategy. How to Challenge Your Assessment. Nassau County collects on average 179 of a propertys assessed fair market value as property tax.

904 225-8878 or 800 671-6774 Fax. An Income Method for commercial real properties estimates the ensuing lease income to establish current fair market value. The minimum combined 2022 sales tax rate for Nassau County New York is.

Nassau County Tax Collector. Low Income Owner-Occupied Primary Residences Tax Exemption FAQs. 86130 License Road Suite 3.

New York City and Nassau County have a 4-class property tax system. The US average is 46. Nassau County property taxes are assessed based upon location within the county.

New York City has four tax brackets ranging from 3078 to 3876. Some cities and local governments in Nassau County collect additional local sales taxes which can be as high as 4875. Higher maximum sales tax than any other New York counties.

Nasssau County Florida Tax Collector. Discover Helpful Information and Resources on Taxes From AARP. - Tax Rates can have a big impact when Comparing Cost of Living.

Ownership eligibilityowning a property for at least 12 consecutive months before filing for the exemption. Based on latest data from the US Census Bureau. - The Income Tax Rate for Nassau County is 65.

Rules of Procedure PDF Information for Property Owners. The Tax Collector has the authority and obligation to collect all taxes as shown on the tax roll by the date of delinquency. Nassau County Property Taxes Range.

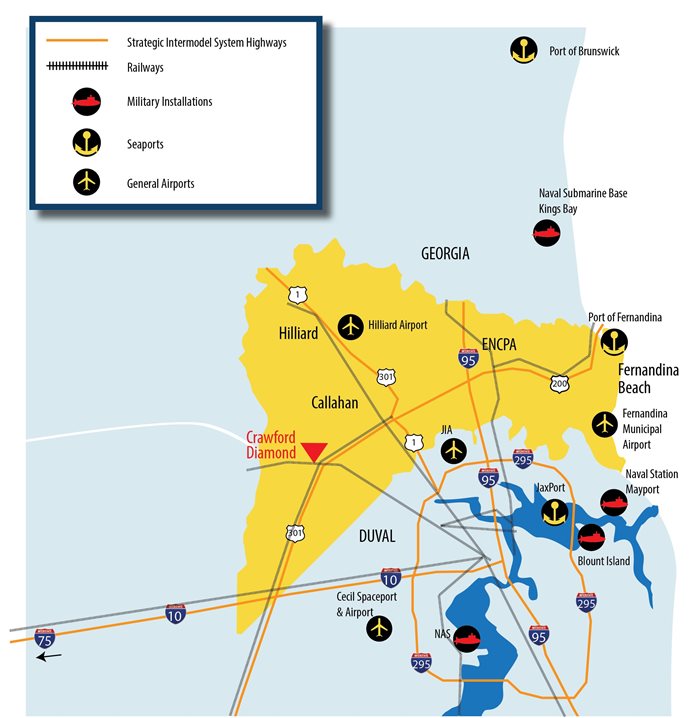

Nassau County Economic Development Board 76346 William Burgess Boulevard Yulee FL 32097 Phone. Answer 1 of 4. The New York state sales tax rate is currently.

What is the sales tax rate in Nassau County. Tax Rates By City in Nassau County New York. 904 225-8868 Send an email Send us an email.

Assessment Challenge Forms Instructions. The 2018 United States Supreme Court decision in South Dakota v. Ad Compare Your 2022 Tax Bracket vs.

Nassau County collects relatively high property taxes and is ranked in the top half of all. The lowest rate applies to single and married taxpayers who file separate returns on incomes of up to 12000 as of 2020. Tax rates in each county are based on combination of levies for county city town village school district and certain special district purposes.

The steep NYC Income Tax surcharge in addition to Fedeal and NY State income taxes is also why some New Yorkers are tempted to cheat a. This is the total of state and county sales tax rates. Nassau County property taxes are among the highest in the nation but there is good news there are many exemptions that help you reduce this tax bite often by a considerable margin.

If you would like more information and are interested in learning more about what tax advantages may be applicable to your business please call our office at 904-225-8878. The US average is 28555 a year. Heres how Nassau Countys maximum sales tax rate of 75 compares to other counties around the United.

- The Median household income of a Nassau County resident is 98401. Property Taxes Assessment Wills Estates Annual Tax Lien Sale Annual Tax Lien Sale-Terms of Sale. Heres how Nassau Countys maximum sales tax rate of 8875 compares to other counties around the United States.

For New York City tax rates reflect levies for general city and school district purposes. Age eligibilitybeing 65 years old or older at the time of filing for the senior property tax exemption. I am adamantly opposed to the proposed law which will 1 raise gas taxes 55 cents to 9812 cents per gallon which will make New Yorks gas tax 57 higher than the state.

The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Income eligibilityhaving a household income that does not exceed Nassau Countys maximum income limit of 37399. The income requirement can.

The Nassau County Sales Tax is collected by the merchant on all qualifying sales made. 2022 Income Limits Published by Florida Housing Finance Corporation. I had paid a NYC Commuter Tax until 1999 now good riddance.

I support the Nassau County Legislative Majoritys call to stop Albanys proposed law S4264A A6967 which will increase taxes on gasoline and products to heat our homes. Nassau County Property Taxes Range. Nassau County Tax Lien Sale.

Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143 counties in order of median property taxes.

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Best Places To Live In Nassau County Florida

Transportation And Infrastructure Nassau County Economic Development Board

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Property Taxes Going Up In Nassau County Is Gas Tax Next

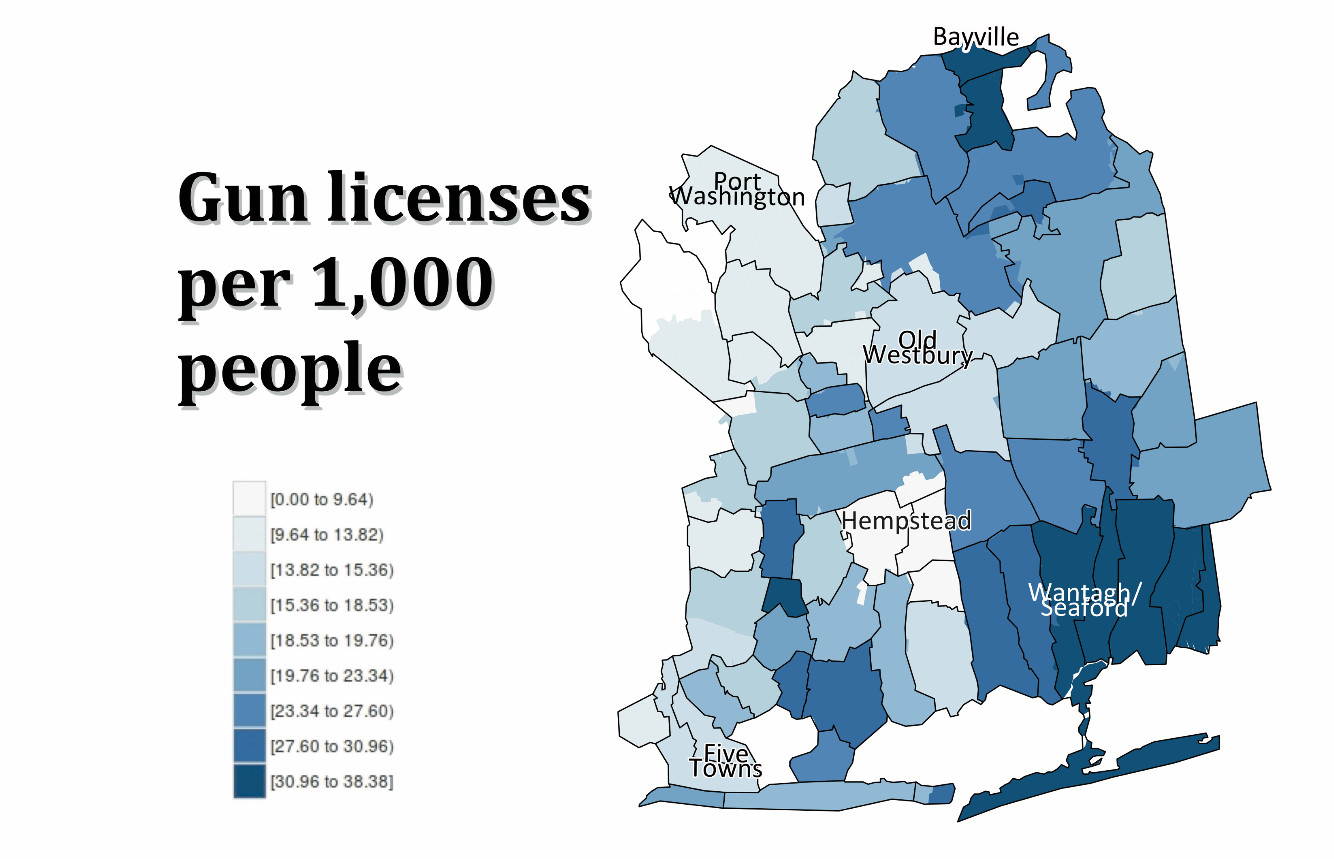

Segregation Is Alive And Well In Nassau County Herald Community Newspapers Www Liherald Com

Property Taxes In Nassau County Suffolk County

Tax Grievance Appeal Nassau County Apply Today

Signs Of Economic Vitality Abound In Nassau County Amelia Island Living

Fulton County Residents Who Live In A Home They Own May Be Able To Reduce Property Taxes By Making Sure They Are Ta Property Tax Mortgage Rates Property Values

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

2022 Best Places To Live In Nassau County Ny Niche

Civil Service Exams Nassau County Ny Official Website

Getting To Know Nassau S Legal Gun Owners Herald Community Newspapers Www Liherald Com

All The Nassau County Property Tax Exemptions You Should Know About

Make Sure That Nassau County S Data On Your Property Agrees With Reality